My Medical Benefits

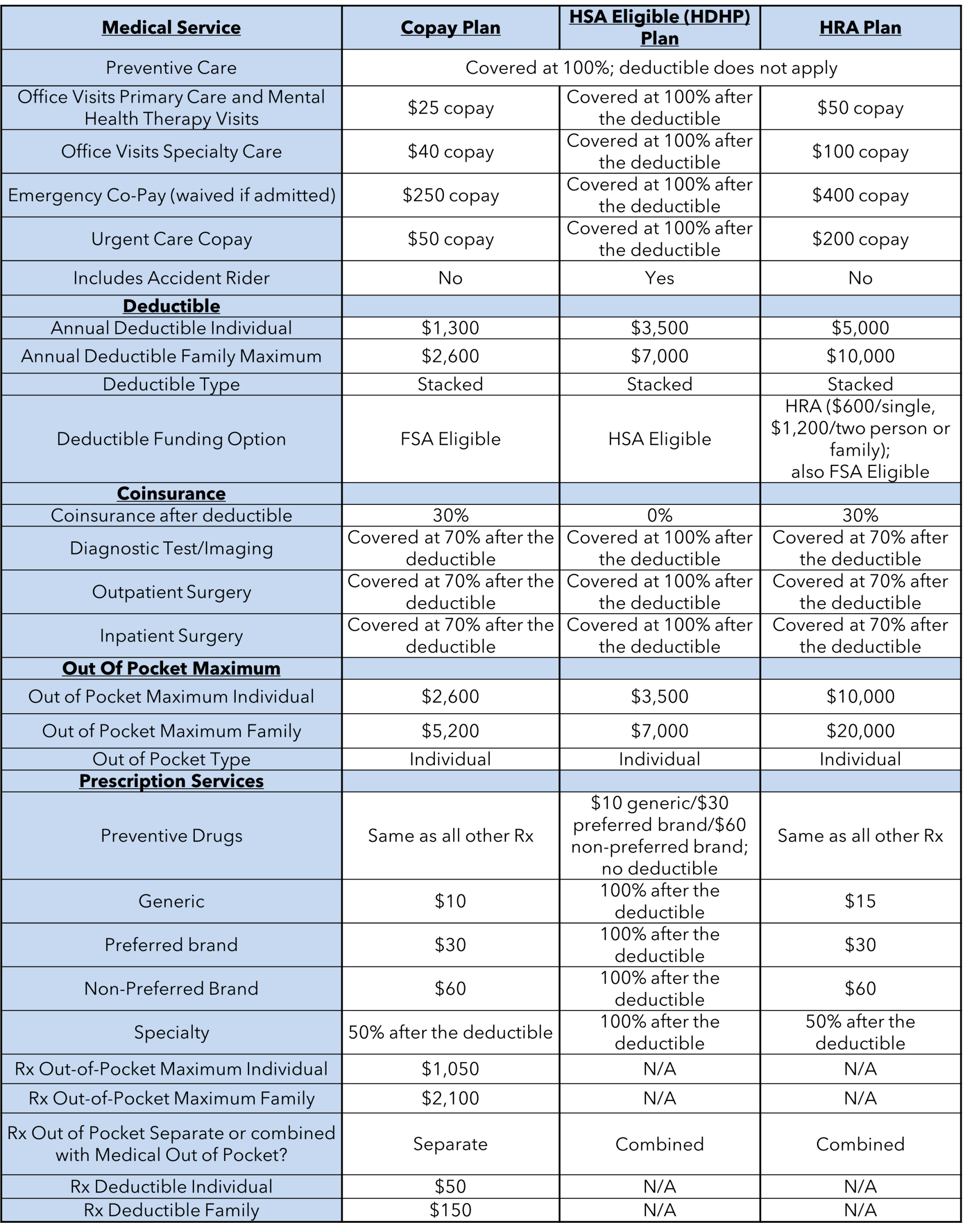

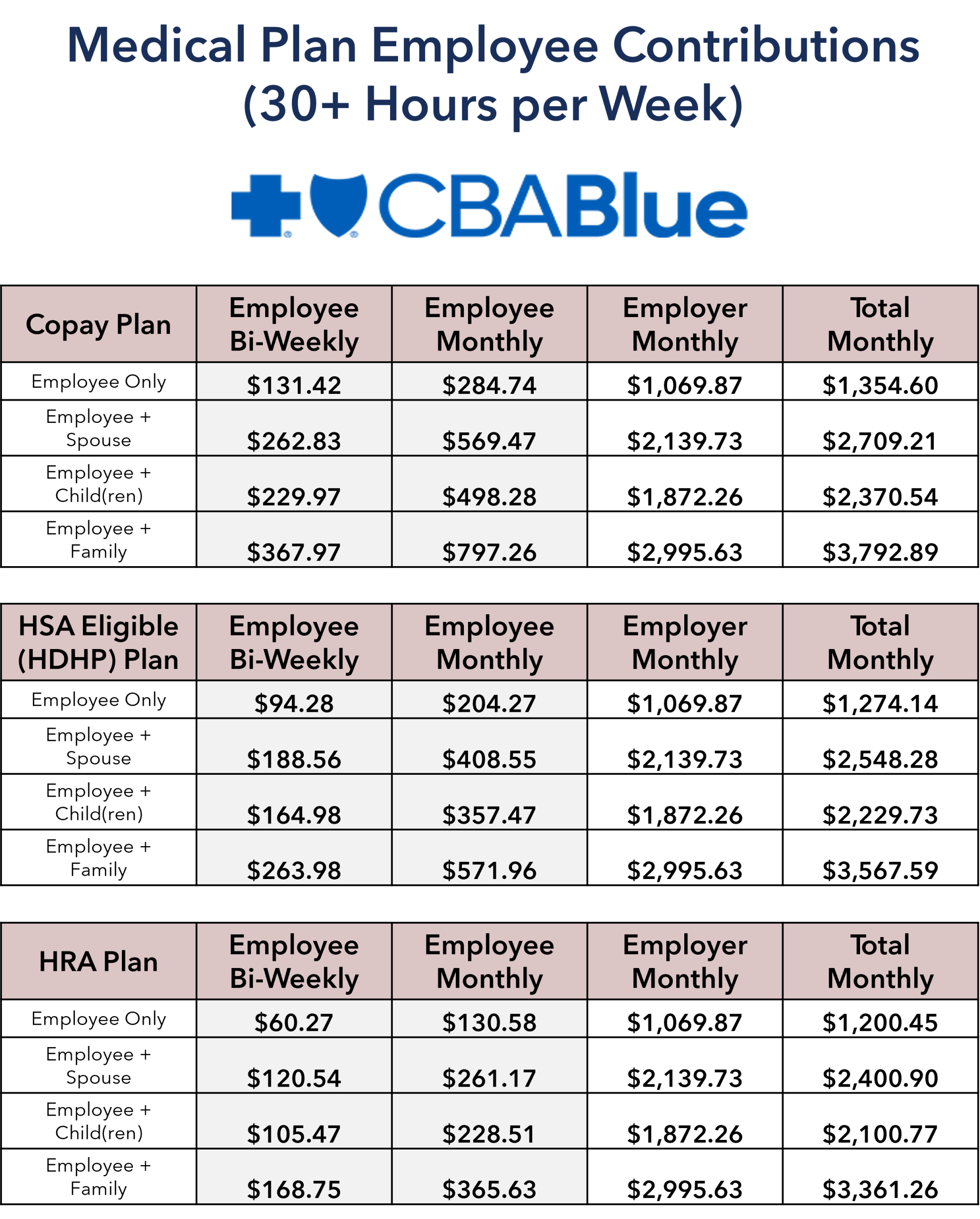

WCMHS offers 3 medical plans to choose from:

- Copay Plan

- HSA Eligible (HDHP) Plan

- HRA Plan

Summary of Benefits

Contributions

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coincident with one month of eligible employment.

Children are covered to age 26 (coverage expires the date the dependent turned 26).

Contact Information

![]()

www.cbabluevt.com

(888) 222-9206

Plan Documents

Plan Amendments

CBA Blue LIVE Telemedicine

CBA Blue LIVE provides members with convenient, quality medical consultations via telephone, secure video, and secure email. Health care professionals can evaluate and diagnose many common conditions and recommend treatment plans, including a prescription called into the pharmacy of choice. There are numerous benefits to telemedicine: immediate access to care, no time spent in a waiting room, no transportation time, less time away from work, and privacy assurance.

Additional Information

My Pharmacy Benefits

WCMHS uses SmithRx for prescription coverage. The amount you will pay for your prescriptions depends on which tier drug you are taking and which plan you are on.

SmithRx works with you and your doctor to find the drug you need at the lowest possible cost. It is important to take their calls, as it will help you save money!

SmithRx Portal Login

In your online SmithRx portal, you’ll have access to your pharmacy benefit information, digital ID card, prescription history, important notifications, and tools to save on your medications. Visit member.mysmithrx.com to log in or sign up.

You can find login and registration instructions in the document below:

Formulary

What is a Formulary?

A Formulary is a list of drugs covered by a prescription drug plan. The brand name drugs listed on the formulary are deemed most effective to treat the condition and are the most cost effective. The generic drugs listed on the formulary are also effective, they are just lower cost because they have been around longer.

Find My Meds Tool

With SmithRx’s Find My Meds tool, you can easily search for the online or retail pharmacy near you where you can get your drugs for the lowest out of pocket cost. This tool takes into account your current pharmacy plan benefits so you see not just an estimated price but the actual amount you will be charged.

Eligibility

Employees working a minimum of 30 hours per week and enrolled in the medical plan receive pharmacy benefits.

Children are covered to age 26 (coverage expires the date the dependent turned 26).

Additional Pharmacy Documents

My Maternity Care Benefits

The Maternity Perks Program provides additional benefits to CBA Blue members during and after pregnancy. Additional benefits include reimbursement for:

• Car Seats: The Plan provides up to $150 for car seats purchased during pregnancy or up to three (3) months after delivery.

• Maternity Fitness Classes: The Plan provides up to $150 for maternity fitness classes

taken during pregnancy and up to three (3) months after delivery.

• Homemaker Services: The Plan provides up to $225 for homemaker services received

within the first three (3) months after delivery.

• Educational Classes: The Plan provides up to $125 for educational classes taken during pregnancy and up to three (3) months after delivery dealing with topics like childbirth, siblings, parenting, and CPR.

To receive your Maternity Perks Program benefits, the member must file a claim and a paid receipt within six (6) months following delivery. Claim forms are available at your Human Resources office or by visiting our website at www.cbabluevt.com.

My CancerCARE Benefits

How it Works for Employees:

The CancerCARE Program is an additional benefit, provided by your health plan, that focuses on helping members diagnosed with cancer. They are your cancer advocates and will strive to lead you and your dependents to survivorship!

- Day One Help: CancerCARE is available to help you from the day of your diagnosis and beyond. You can register for the program at any point in your cancer journey to gain access to CancerCARE’s resources and support.

- Personalized Care: Once you are part of the program, a dedicated nurse will be with you every step of the way. This nurse will be available to answer any questions you might have as well as receive ideal treatment.

- National Resources: Through CancerCARE, you will have access to some of the best doctors, hospitals, and technology nationwide. They will work with your local oncologist to make sure all treatment options are considered, not just local ones.

- Medical Expert Team: CancerCARE’s medical staff has decades of experience treating cancer and we pride ourselves on staying up-to-date with the latest cancer treatments and technology. Each medical staffer has unique cancer expertise and background.

Additional Information

My Health Reimbursement Account

Health Reimbursement Account (HRA)

WCMHS offers a Health Reimbursement Account attached to the HRA Medical Plan, administered by EBPA Benefits.

A Health Reimbursement Account (HRA) is money your employer sets aside to help you pay for qualified medical expenses. You do not contribute to your HRA account directly—WCMHS funds the account for you. This benefit is designed to lower your out-of-pocket costs and make your healthcare more affordable.

The HRA allows for reimbursement for deductible expenses incurred if you are enrolled in the HRA Plan. The funding amounts provided to the HRA by WCMHS will be made available on the first day of the plan year. The HRA pays the first $600 (single) and $1,200 (family) of qualified deductible expenses.

HRA dollars cannot be used to cover copays.

Excluding copays, the HRA provides first-dollar coverage for your health care services. Expenses are considered “incurred” when the service is performed. Your provider will be paid directly; you will not need to submit substantiation for claims. Only expenses incurred in the calendar plan year (January 1 through December 31) will be eligible for reimbursement from that year’s HRA.

Eligibility

All full-time employees who work at least thirty (30) hours per week and are enrolled in the HRA Medical Plan are eligible for coverage the first of the month following 1 month of employment.

My Flexible Spending and Dependent Care Account Benefits

Medical Flexible Spending Account (FSA)

FSA funds may be used for office visit copays, medical plan deductible, dental expenses, vision expenses, and prescription drug copays as well as any medical/prescription expenses covered under your health plan and any other IRS-eligible expenses.

(You can submit expenses for 2025 until March 31st, 2026. The last day to incur expenses is March 15th, 2026). The medical FSA cannot be used on the HSA Eligible (HDHP) Plan.

Medical FSA funds are available in full at the start of the plan year. You may roll over up to $680 from the previous calendar year to the current plan year. Any unused funds exceeding the rollover amount at the end of the plan year will be forfeited.

For 2026, you may contribute up to $3,400 on a pre-tax basis per calendar year to your Medical FSA account.

Please Note: Over the Counter (OTC) medications (Tylenol, Advil etc.) are not reimbursable through the FSA without a prescription. All claims for OTC medications, with a prescription, must be submitted manually. You will not be able to purchase these items with your card. You may still purchase Over the Counter supplies (Saline contact solution, bandages, etc.) without a prescription and you may use your card for these items.

Dependent Care Flexible Spending Account (DCA)

DCA funds may be used for eligible dependent care expenses (including care for children, elders, and disabled adults). DCA funds are available as they are deducted from pay. DCA funds not used in the plan year in which they were deducted from your pay are forfeited.

The 2026 DCA contribution limits are $7,500 for single individuals or married couples filing jointly and $3,750 for married individuals filing separately.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

My Health Savings Account Benefits

Health Savings Account

An HSA is available with only the HSA Eligible (HDHP) Plan. For a list of qualified expenses please visit here.

Employees may make a maximum contribution of $4,400/$8,750 (depending on tier). If you are over the age of 55 you may make an additional contribution of $1,000. This is only if you enroll in the HSA Eligible (HDHP) Plan.

The HSA is owned by the employee. Existing accounts can be transferred to HealthEquity using these instructions.

Want to learn more? Check out: http://healthequity.com/learn/hsa

Take control of your health and grow your money. Discover how to use a Health Savings Account (HSA) to save on healthcare premiums and build long-term health savings.

Your HSA is like a second 401(k). It’s a powerful investment tool. Find out how to invest your HSA and build the ultimate retirement nest egg.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

Forms & Other Plan Information

My FSA/HSA Store Benefits

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

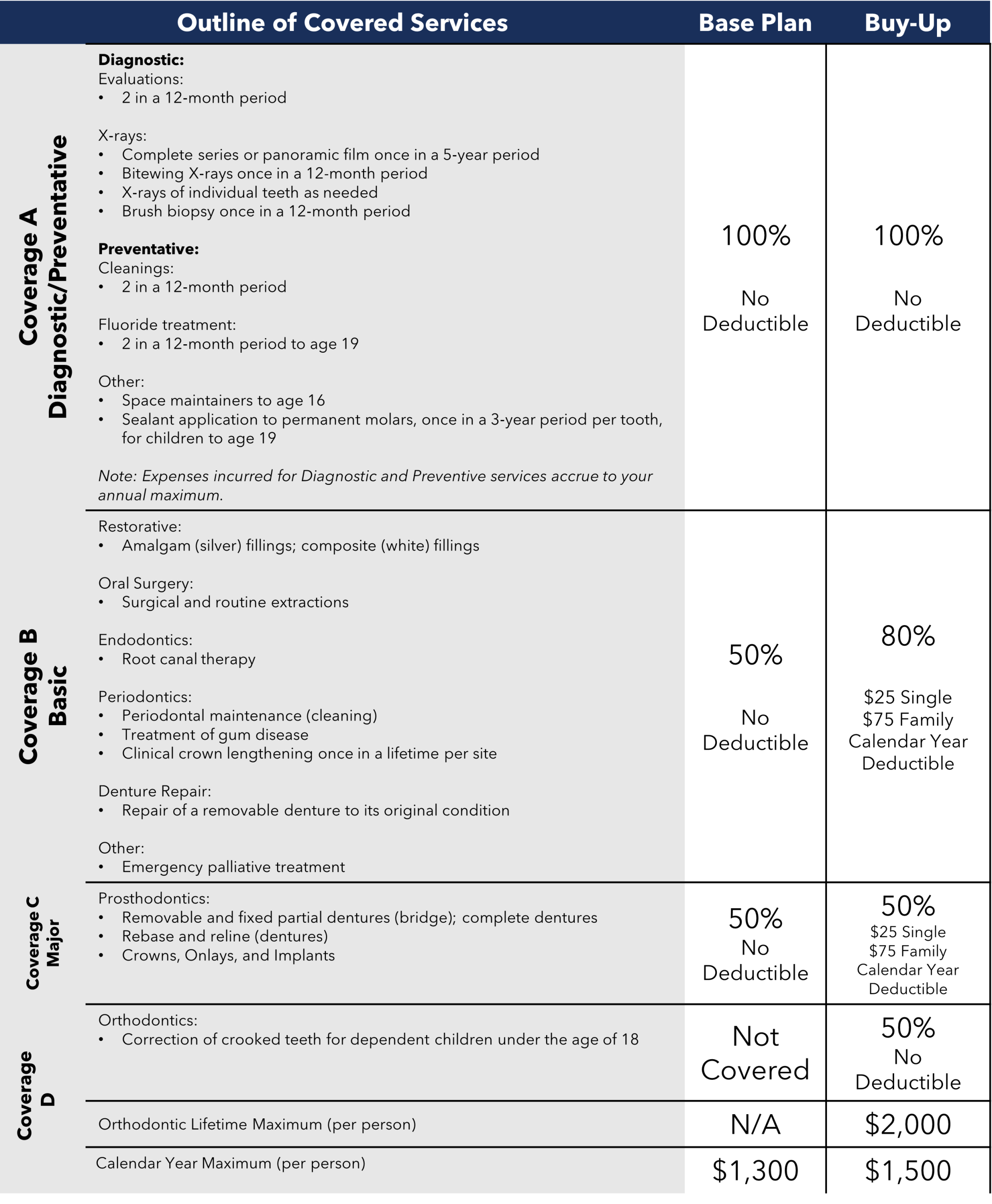

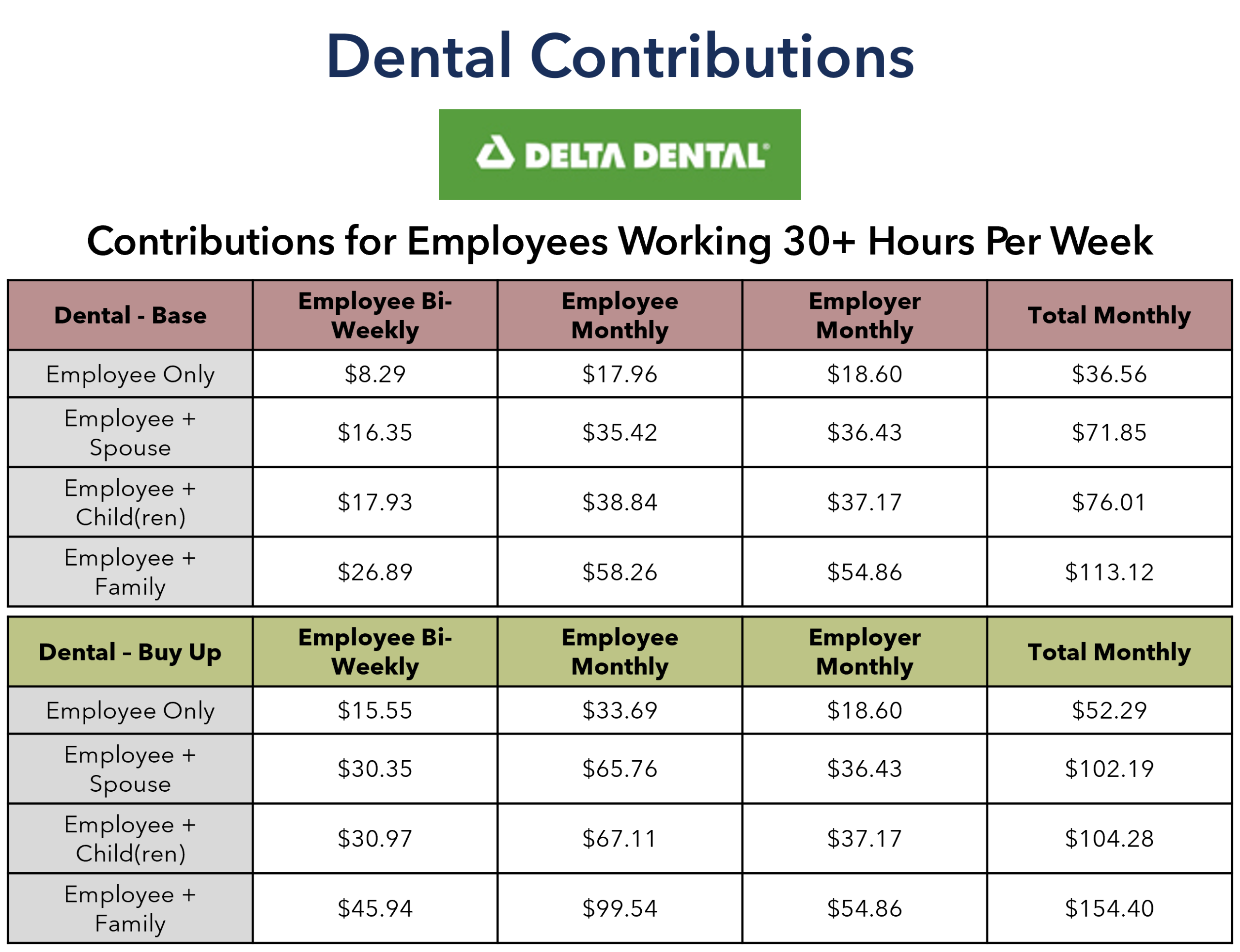

My Dental Benefits

WCMHS offers two comprehensive dental plans to employees through Northeast Delta Dental.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment

Children are covered to age 26 (coverage expires the date the dependent turned 26).

Contact Information

![]()

http://www.nedelta.com/patients

1-800-832-5700

Use the link above to find a dentist in the PPO or Premier networks.

Plan Documents

Get the most out of your Delta Dental plan:

Delta Dental provides its members with a vision discount program through Eyemed. Enjoy savings just from being a Delta Dental member.

Health Through Oral Wellness (HOW)

A healthy mouth is part of a healthy life, and Northeast Delta Dental’s innovative Health through Oral Wellness program (HOW) works with your dental benefits to help you achieve and maintain better oral wellness. HOW is all about YOU because it’s based on your specific oral health risk and needs. Best of all, it’s secure and confidential. Here’s how to get started:

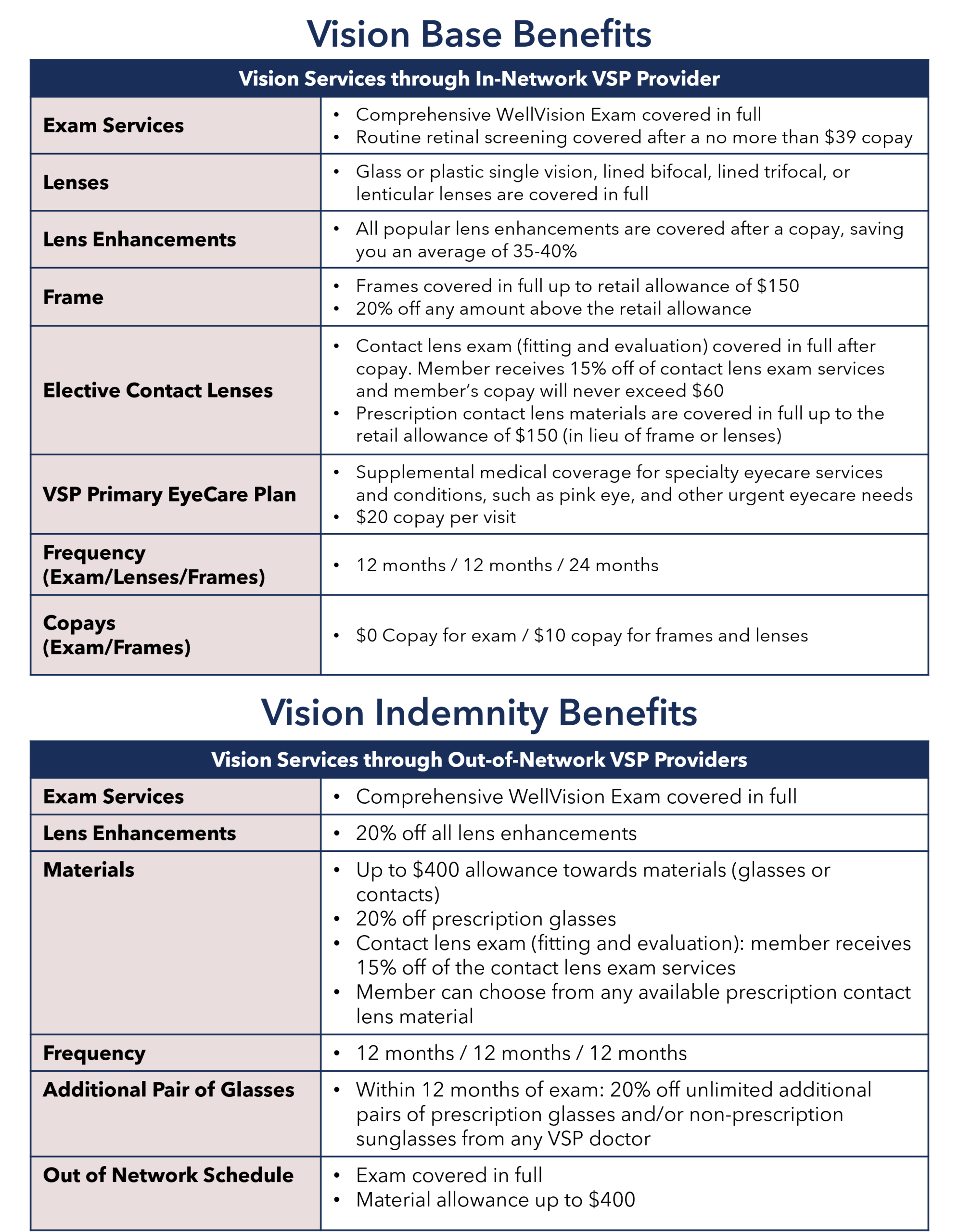

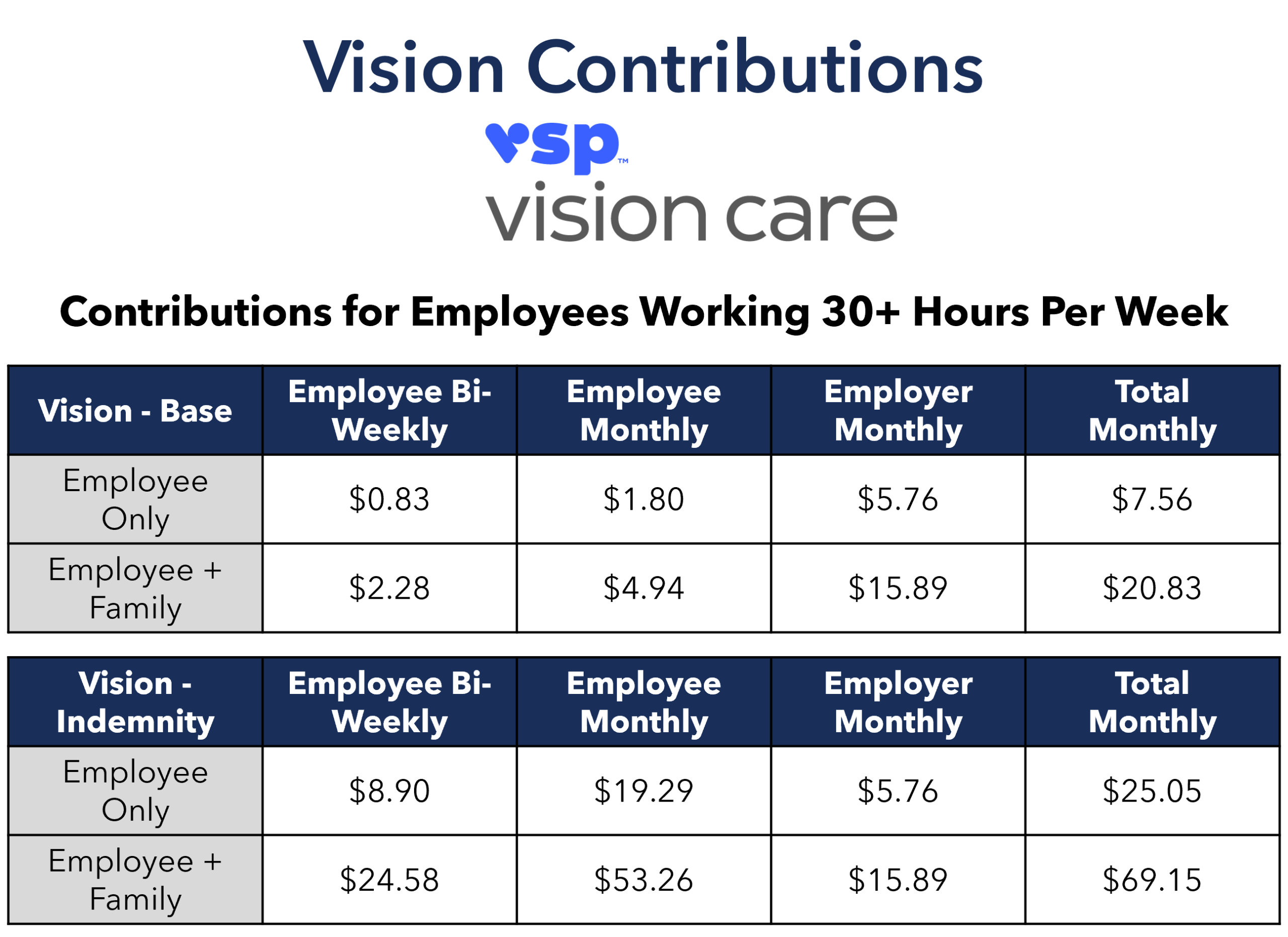

My Vision Benefits

WCMHS offers two vision plans to its employees. One plan is an in-network plan with VSP providers, and the other is an out-of-network Buy-Up option.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

Children are covered to age 26 (coverage expires the date the dependent turns 26).

How to Submit an Out-of-Network Claim

- Go to www.vsp.com and log into your account

- Click on “Benefits” at the top of the webpage (“View Your Benefits” on the mobile app)

- Click on the blue button that reads “Submit a Claim” under “Oops! Did You Go Out of Network?”

- Scroll down and click on the blue button that reads “Start New Claim”

- Enter in the requested information pertaining to your out-of-network visit. If you do not see your eye doctor/office name listed in the dropdown, select “Other” at the bottom of the dropdown and manually type in the name of the eye doctor/office name where you received services.

- Complete information on the type of vision services you received (exam, frames, contacts, etc.)

- Complete patient information

- Attach receipts

- Submit claim!

Plan Documents

Other Plan Information

Through VSP, you also receive hearing aid discounts.

Enjoy online shopping for frames through VSP’s Eyeconic program:

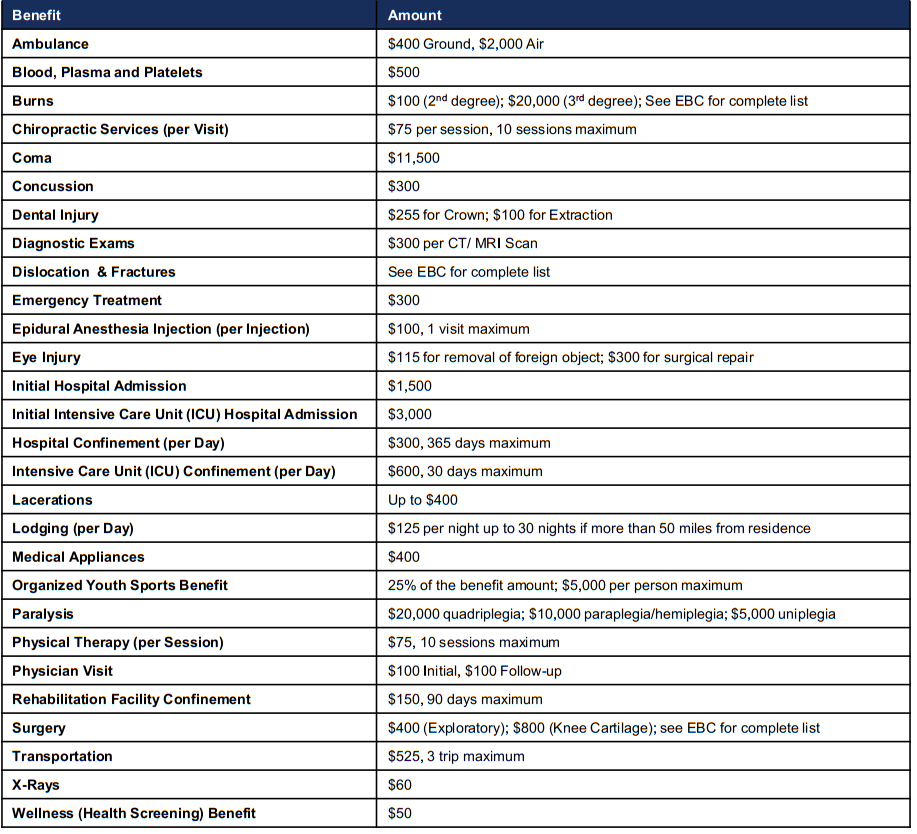

Accident Rider

The Agency provides employees with an accident policy that pays a certain benefit amount per injury; see certificate for specifics. This accident policy is automatically paired with your HSA Eligible (HDHP) Plan and is paid for by WCMHS. If you are not enrolled in the HSA Eligible (HDHP) Plan, you can enroll in accident coverage through payroll deductions.

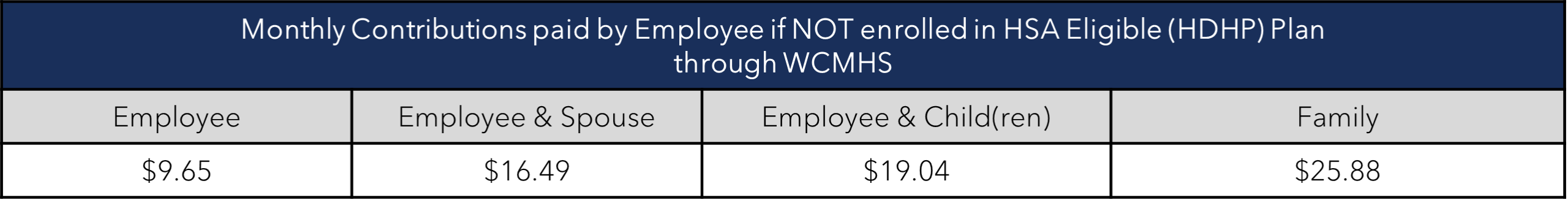

Contributions

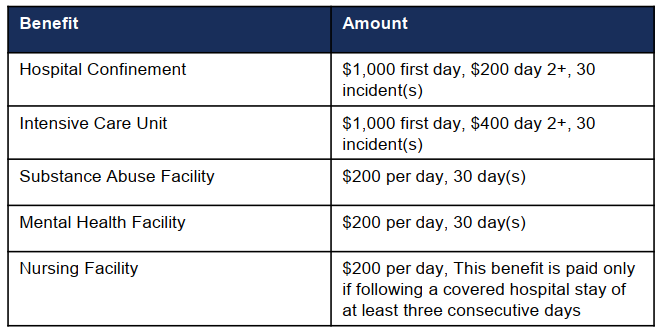

My Voluntary Hospital Indemnity Benefits

This coverage provides a range of lump-sum benefits based on your hospitalization. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

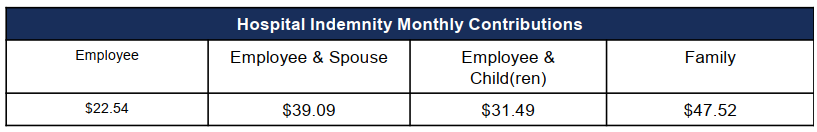

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage. Coverage begins on the 1st of the month following/coincident with 30 days.

My Life and AD&D Benefits

The Agency offers their employees Life and Accident Death and Dismemberment coverage. The benefit gives employees basic life and AD&D insurance that is equal to 2x salary, rounded to next $1,000 to a maximum of $300,000. It is important to note that your benefit will reduce upon certain ages. At age 65, your life insurance benefit reduces to 65% of the original amount. At age 70, your life insurance benefit reduces to 50% of the original amount.

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Short Term Disability Benefits

The Agency offers their employees a Short Term Disability benefit.

Elimination Period:

- 0 Calendar Days for Accident

- 7 Calendar Days for Illness

Benefit Amount:

50% of your weekly benefit amount no greater than $2,000 per week.

Maximum Benefit Period due to Injury or Accident:

- The end of the disability

- The end of the 25th week of Disability for which a benefit is payable

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Long Term Disability Benefits

The Agency offers their employees a Long Term Disability benefit.

Benefit Amount:

60% of Basic Monthly Earnings not to exceed a Maximum Monthly Benefit of $5,000 – see certificate for additional details

Elimination Period:

The greater of:

- the end of your STD Benefits; or

- 180 days

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Voluntary Life and AD&D Benefits

The Agency offers employees Voluntary Life and Accidental Death & Dismemberment coverage.

The benefit allows employees to elect a benefit amount for voluntary life and/or voluntary accidental death and dismemberment in $10,000 increments to a maximum of 5x your annual earnings up to $500,000. Any amounts over $150,000 will be subject to Evidence of Insurability.

Employees can elect voluntary life and/or voluntary accidental death and dismemberment on their spouse in $5,000 increments. The benefit must be the lesser of 50% of the Employee’s Voluntary Life benefit or $250,000. Any amounts over $25,000 will be subject to Evidence of Insurability.

Employee can elect voluntary life and/or voluntary accidental death and dismemberment on their child.

- Live birth to 6 months: $500

- 6 months to 26 years: $5,000 increments up to $10,000.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage. Coverage begins 1st of the month following 1 month of continuous employment.

My EAP Benefits

KGA Employee Assistance Program (EAP)

The Agency provides all employees with access to an Employee Assistance Program (EAP) through KGA, an independent, industry-leading provider. This voluntary and confidential program offers professional counseling and referral services to support employees with personal, work-related, or family concerns.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

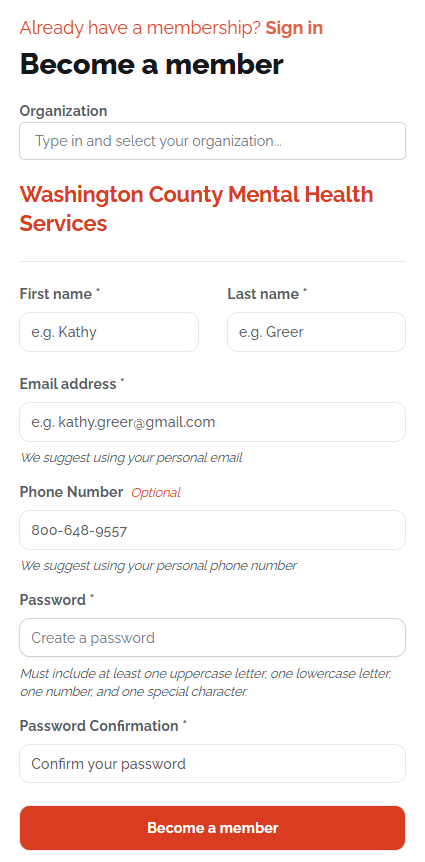

Getting Started

To sign up, visit https://my.kgalifeservices.com/users/sign_up

and type “Washington County Mental Health Services” into the Organization box. Then, enter your name, email, and phone number, and create a password.

KGA Counseling

KGA EAP offers 5 free sessions per issue per year. Licensed professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- Financial issues

- Legal issues

- Referrals you for in-person counseling

KGA Peer Support

KGA EAP offers 10 free virtual group sessions per year, providing peer support on the following topics:

- Addiction Recovery

- ADHD

- Anxiety

- Bipolar Disorder

- Divorce

- Get It Done When You’re Depressed

- Grief

- Making Exercise Fun

- Parenting & Caregiving

- Postpartum

KGA LifeServices Resource Library

On KGA’s LifeServices free online resource library, you can access an array of helpful mental health resources such as live webinars, videos, podcasts, and articles. You will also be able to participate in organized wellness/mindfulness challenges.

KGA App – MindTide

Once you’ve created an account in the KGA LifeServices platform, you’ll be able to sign up for KGA’s additional app, MindTide. Visit https://my.kgalifeservices.com/mindtide to receive a one-time code that you will use to register for the MindTide app.

The KGA MindTide app offers brief, easy-to-use exercises, courses, and audio tools that can help you cope with anxiety, navigate interpersonal relationships, practice mindfulness, and build self-esteem.

Symetra Support

The Agency also provides a supplemental EAP through Symetra. Your household is eligible for a total of five sessions per calendar year, plus an additional five with a covered disability claim.

Symetra Support can assist with the following:

- Confidential counseling (mental health, substance abuse, grief, family issues)

- Financial information and resources (debt management, tax questions)

- Legal support (contracts, divorce/family law, bankruptcy, etc.)

Symetra Support offers these additional services:

- Travel assistance

- Identity theft protection

- Estate Guidance and Beneficiary Assistance

Symetra Support also has a wealth of online resources and tools, such as articles, tutorials, and self-assessments.

The Agency’s EAPs through KGA and Symetra Support are confidential services. No one will know if you use the EAPs – not your supervisor, the Agency, or your family members. Any information you provide to KGA or Symetra Support is confidential and cannot be shared without your explicit consent.

Contributions

The KGA and Symetra Support EAP benefits are provided by the company at no charge to employees, per contract limits.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

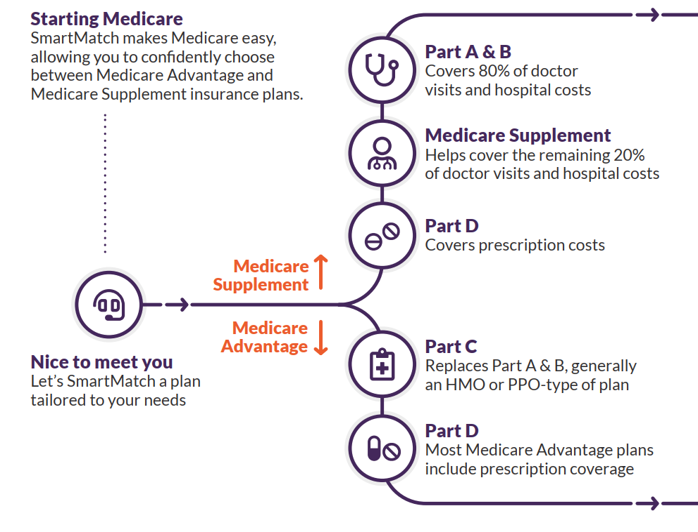

SmartConnect – Medicare Resource

Medicare is very complex and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans, and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

SmartConnect is a free resource that will simplify the Medicare approach by providing you the needed education, plan evaluation, and enrollment assistance.

SmartConnect Contact Information

Additional Information

Tuition Assistance

Tuition Reimbursement – GRADFIN

The Washington County Mental Health Service Inc’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing WCMHS’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

WCMHS Tuition Reimbursement & Loan Repayment

WCMH’S educational assistance program provides tuition assistance and loan repayment of up to $5250 per year for eligible staff who are pursuing or have pursued a degree or coursework relevant to their current or future job responsibilities.

To learn more about either of these programs and eligibility contact: educationbenefits@wcmhs.org