2024

Benefits at a Glance

My Medical Benefits

|

Summary of Benefits

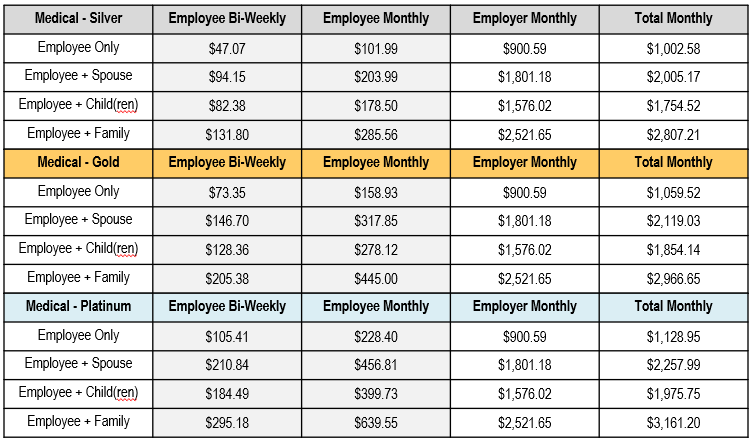

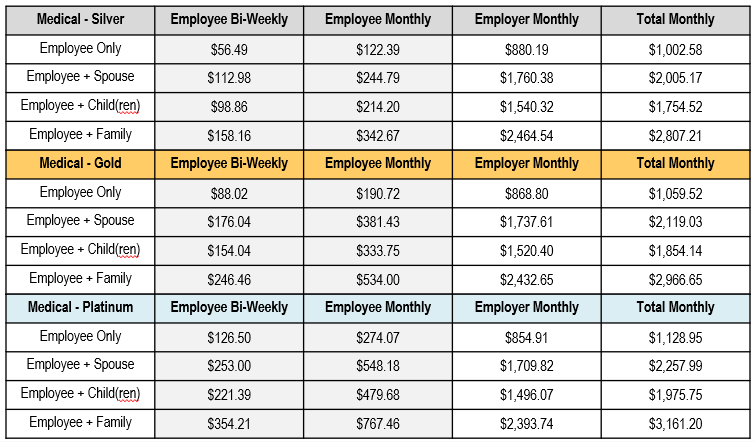

Contributions

Contributions for Employees Working 35 + Hours Per Week

Contributions for Employees Working 30-34.9 Hours Per Week

Eligibility

Employees working a minimum of 30 hours per week are eligible to enroll on the first of the month following/coincident with one month of eligible employment.

Children are covered to age 26 (coverage expires the date the dependent turned 26).

CBA Blue LIVE Telemedicine

CBA Blue LIVE provides members with convenient, quality medical consultations via telephone, secure video, and secure email. Health care professionals can evaluate and diagnose many common conditions and recommend treatment plans, including a prescription called into the pharmacy of choice. There are numerous benefits to telemedicine: immediate access to care, no time spent in a waiting room, no transportation time, less time away from work, and privacy assurance.

Additional Plan Documents

Pharmacy Documents

My Maternity Care Benefits

The Maternity Perks Program provides additional benefits to CBA Blue members during and after pregnancy. Additional benefits include reimbursement for:

• Car Seats: The Plan provides up to $150 for car seats purchased during pregnancy or up to three (3) months after delivery.

• Maternity Fitness Classes: The Plan provides up to $150 for maternity fitness classes

taken during pregnancy and up to three (3) months after delivery.

• Homemaker Services: The Plan provides up to $225 for homemaker services received

within the first three (3) months after delivery.

• Educational Classes: The Plan provides up to $125 for educational classes taken during pregnancy and up to three (3) months after delivery dealing with topics like childbirth, siblings, parenting, and CPR.

To receive your Maternity Perks Program benefits, the member must file a claim and a paid receipt within six (6) months following delivery. Claim forms are available at your Human Resources office or by visiting our website at www.cbabluevt.com.

My CancerCARE Benefits

How it Works for Employees:

The CancerCARE Program is an additional benefit, provided by your health plan, that focuses on helping members diagnosed with cancer. We are your cancer advocates and will strive to lead you and your dependents to survivorship!

- Day One Help: We are available to help you from the day of your diagnosis and beyond. You can register for the program at any point in your cancer journey to gain access to our resources and support.

- Personalized Care: Once you are part of the program, a dedicated nurse will be with you every step of the way. This nurse will be available to answer any questions you might have as well as receive ideal treatment.

- National Resources: Through Cancer CARE, you will have access to some of the best doctors, hospitals, and technology nationwide. We will work with your local oncologist to make sure all treatment options are considered, not just local ones.

- Medical Expert Team:Our medical staff has decades of experience treating cancer and we pride ourselves on staying up-to-date with the latest cancer treatments and technology. Each medical staffer has unique cancer expertise and background.

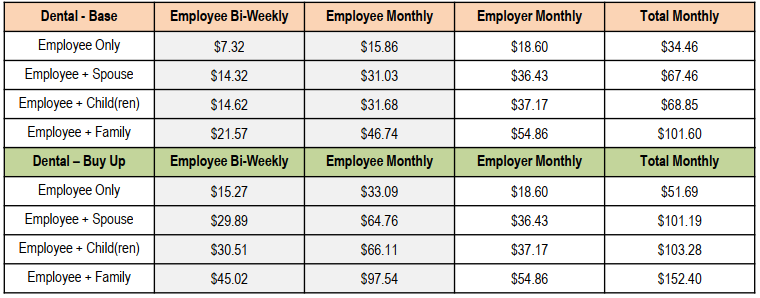

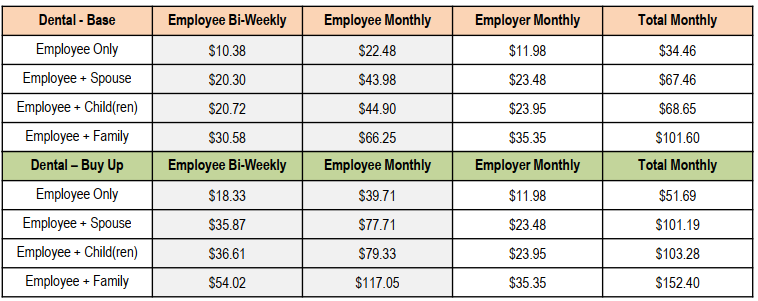

My Dental Benefits

WCMHS offers a comprehensive dental plan to its employees through Northeast Delta Dental.

Northeast Delta Dental Videos

Contributions

Contributions for Employees Working 35+ Hours Per Week

Contributions for Employees Working 30-49 Hours Per Week

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment

Children are covered to age 26 (coverage expires the date the dependent turned 26).

Contact Information

![]()

http://www.nedelta.com/patients

1-800-832-5700

Use the link above to find a dentist in the PPO or Premier networks.

Learn how to get the most out of your Delta Dental plan:

Delta Dental provides its members with a vision discount program through Eyemed. Enjoy savings just from being a Delta Dental member.

Health Through Oral Wellness (HOW)

A healthy mouth is part of a healthy life, and Northeast Delta Dental’s innovative Health through Oral Wellness program (HOW) works with your dental benefits to help you achieve and maintain better oral wellness. HOW is all about YOU because it’s based on your specific oral health risk and needs. Best of all, it’s secure and confidential. Here’s how to get started:

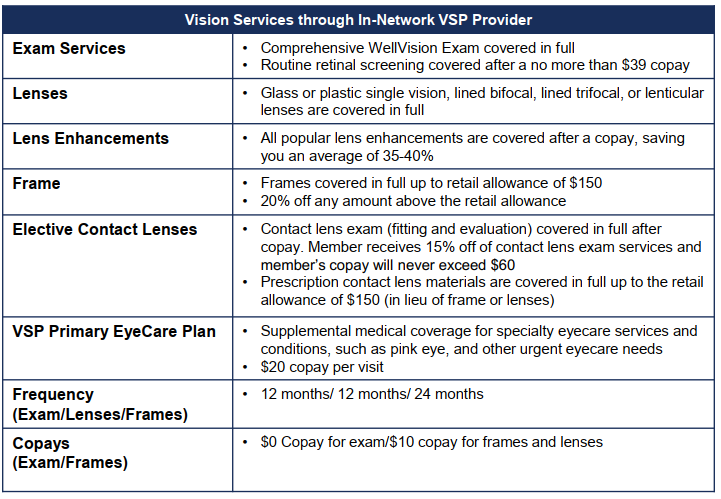

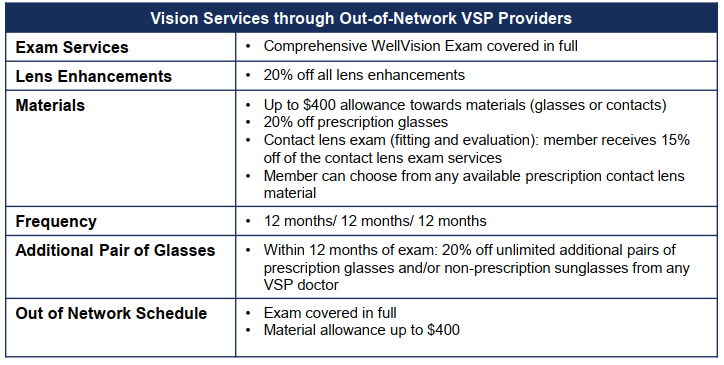

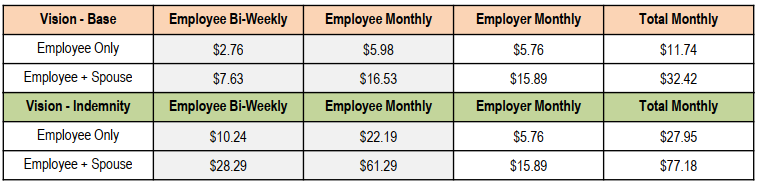

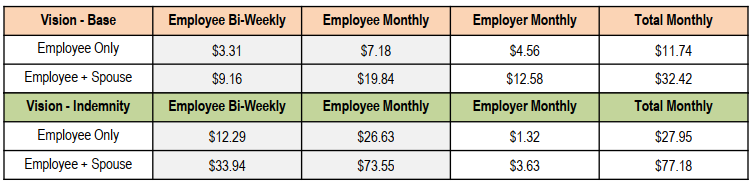

My Vision Benefits

WCMHS offers two vision plans to its employees. One plan is an in-network plan with VSP providers, and the other is an out-of-network Buy-Up option.

Contributions for Employees Working 35+ Hours Per Week

Contributions for Employees Working 30-34.9 Hours Per Week

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

Children are covered to age 26 (coverage expires the date the dependent turns 26).

Contact Information

1-888-555-1212

Choose the “Signature” network when searching for a provider.

Other Plan Information

Through VSP, you also benefit from hearing aid discounts.

Enjoy online shopping for frames through VSP’s Eyeconic program:

My Flexible Spending and Dependent Care Account Benefits

An FSA is an annual election that can be deducted from your pay pre-tax in equal increments throughout the year. FSA dollars are available immediately at the start of the plan year (January 1st). The annual election amount is chosen by the employee up to a maximum allowed by the IRS. You have until March 31st of each year to submit for reimbursement claims from the previous year. If you enroll, Health Equity will send you a debit card directly to your home address.

If you have the Platinum or Gold plan, you can enroll in the Flexible Spending Account. You may use your contributions to pay for unreimbursed/uncovered medical, dental and vision expenses.

If you have the Silver HDHP plan, and you have a Health Savings Account, you can only enroll in the Limited Purpose Flexible Spending Account. You may use your contributions to pay for unreimbursed/uncovered dental and vision expenses only – not medical.

You will have until March 15 of the following calendar year to incur expenses to use your FSA balance. All reimbursement requests must be received by March 31st.

FSA Dependent Care Funds can only be reimbursed as they are taken from your paycheck. The annual election amount is chosen by the employee up to a maximum of $5,000 dependent on your tax filing status. Eligible expense for DCA include adult day care center, babysitters, before and after school care, custodial care, and summer day camps.

Please Note: Over the Counter (OTC) medications (Tylenol, Advil etc.) are not reimbursable through the FSA without a prescription. All claims for OTC medications, with a prescription, must be submitted manually. You will not be able to purchase these items with your card. You may still purchase Over the Counter supplies (Saline contact solution, bandages, etc.) without a prescription and you may use your card for these items.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

My Health Savings Account Benefits

Health Savings Account

An HSA is available with only the Silver HDHP Plan. For a list of qualified expenses please visit here. Employees may make a maximum contribution of $4,150/$8,300 (depending on tier). If you are over the age of 55 you may make an additional contribution of $1,000.

The HSA is owned by the employee. Existing accounts can be transferred to HealthEquity using these instructions.

Take control of your health and grow your money. Discover how to use a Health Savings Account (HSA) to save on healthcare premiums and build long-term health savings.

Your HSA is like a second 401(k). It’s a powerful investment tool. Find out how to invest your HSA and build the ultimate retirement nest egg.

Choosing an HSA is only the first step. See the power of an HSA in action. We’ll share three strategies for how to spend less on healthcare and invest even more for the future.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 1 month of employment.

Forms & Other Plan Information

My FSA/HSA Store Benefits

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Accident Rider

The Agency provides employees with an accident policy that pays a certain benefit amount per injury, see certificate for specifics. This accident policy is automatically paired with your Silver medical plan and is paid for by WCMHS. If you are not enrolled in the Silver medical plan, you can enroll in accident coverage through payroll deductions.

Contributions

If you do not elect the Silver HDHP through WCMHS, employee contributions to the accident plan will be pre-tax and taken out of your bi-weekly paycheck. The following are monthly amounts.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage. Coverage begins on the 1st of the month following/coincident with 30 days.

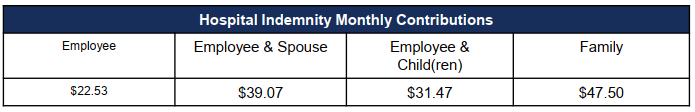

My Voluntary Hospital Indemnity Benefits

This coverage provides a range of lump-sum benefits based on your hospitalization. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage. Coverage begins on the 1st of the month following/coincident with 30 days.

My Life and AD&D Benefits

The Agency offers their employees Life and Accident Death and Dismemberment coverage. The benefit gives employees basic life and AD&D insurance that is equal to 2x salary, rounded to next $1,000 to a maximum of $300,000. It is important to note that your benefit will reduce upon certain ages. At age 65, your life insurance benefit reduces to 65% of the original amount. At age 70, your life insurance benefit reduces to 50% of the original amount.

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Short Term Disability Benefits

The Agency offers their employees a Short Term Disability benefit.

Elimination Period:

0 Calendar Days for Accident/ 7 Calendar Days for Illness

Benefit Amount:

50% of your weekly benefit amount no greater than $2,000 per week.

Maximum Benefit Period due to Injury or Accident:

- the end of the disability

- the end of the 25th week of Disability for which a benefit is payable

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Long Term Disability Benefits

The Agency offers their employees a Long Term Disability benefit.

Elimination Period:

The greater of:

- the end of your STD Benefits; or

- 180 days

Benefit Amount:

60% of Basic Monthly Earnings not to exceed a Maximum Monthly Benefit of $5,000 – see certificate for additional details

Elimination Period:

The greater of:

- the end of your STD Benefits; or

- 180 days

Benefit Amount:

60% of Basic Monthly Earnings not to exceed a Maximum Monthly Benefit of $5,000 – see certificate for additional details

Contributions

This is Employer funded.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage on the first of the month following 6 months of continuous employment.

My Voluntary Life and AD&D Benefits

The Agency offers employees Voluntary Life and Accidental Death & Dismemberment coverage.

The benefit allows employees to elect a benefit amount for voluntary life and/or voluntary accidental death and dismemberment in $10,000 increments to a maximum of 5x your annual earnings up to $500,000. Any amounts over $100,000 will be subject to Evidence of Insurability.

Employees can elect voluntary life and/or voluntary accidental death and dismemberment on their spouse in $5,000 increments. The benefit must be the lesser of 50% of the Employee’s Voluntary Life benefit or $250,000. Any amounts over $25,000 will be subject to Evidence of Insurability.

Employee can elect voluntary life and/or voluntary accidental death and dismemberment on their child.

- Birth to 6 months: $500

- 6 months to 26 years: $5,000 increments up to $10,000.

Eligibility

Full time employees working thirty (30) hours or more per week are eligible for coverage. Coverage begins 1st of the month following 1 month of continuous employment.

My EAP Benefits

The Agency provides all employees with an Employee Assistance Program (EAP) through Invest EAP, an independent, industry-leading company that specializes in health care management. EAP is a voluntary, confidential service that provides professional couseling and referral services designed to help with personal, job or family related problems.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, interactive databases, health and wellness calculators, webinars and podcasts.

Licensed professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- Financial issues

- Legal issues

- They can also refer you for in-person counseling

The Agency’s EAP through Invest EAP is a confidential service. No one will know if you use the EAP-not your supervisor, the Agency, or your family members. Any information you provide to Invest EAP is confidential and cannot be shared without your explicit consent.

Contributions

The EAP benefits are provided by the company at no charge to employees, per contract limits.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

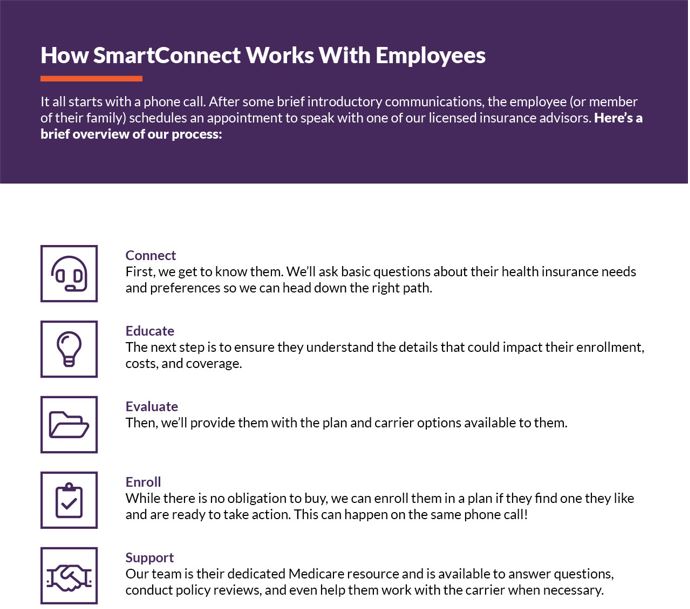

SmartConnect - Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

http://gps.smartmatch.com/pareto

(855) 248-1648 TTY: 711

Additional Information

Tuition Reimbursement – GRADFIN

The Washington County Mental Health Service Inc’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing WCMHS’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

The Educational Benefits Committee

WCMHS, as one of its employee benefits, makes available a set amount of money on an annual basis for the purpose of assisting employees with furthering their educational endeavors. The Educational Benefits Committee is delegated by Board Staff Management Committee to meet this end.

In addition, we have been granted additional funds from the state to support staff pursuing degrees in mental health, substance use and nursing.

Educational Benefits Committee Policies and Procedures:

Our WCMHS funded program: Requests are approved for educational endeavors matriculating toward a degree. Program supervisors need to sign off on the request. Currently we have $30,000 per year to allocate. The Committee divides that allotment by the number of approvals to determine the exact award amount.

Eligibility

- Must have been employed at WCMHS for at least six months

- Must has successfully completed initial probationary period

- All courses must be a part of a matriculated degree program

- All courses must have been completed

- Courses in progress or not completed are not eligible for reimbursement

- An application for educational assistance must be completed, signed by the division direction and submitted to HR prior to the education benefit committee’s quarterly meeting

- Educational assistance applications must be accompanied by a transcript reflecting a passing grade

Our State-funded program: Funds have been allocated for Mental Health and Substance Use Disorder programs.

- Loan repayment for Master’s level clinicians, bachelor’s level direct service and nurses.

- Tuition assistance for individuals pursuing degrees to become master’s level clinicians, bachelor’s level direct service staff and nurses.

To learn more about either of these programs and eligibility contact: educationbenefits@wcmhs.org

Contact Information

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Other Information